For more information about rates of non-resident withholding tax for the various countries or regions with which Canada has tax treaties go to Non-Resident Tax Calculator see Information Circular IC76-12R6 Applicable rate of part XIII tax on amounts paid or credited to persons in countries with which Canada has a tax convention and Information Circular IC77-16R4 Non-Resident Income Tax. Live updates around global mobility shifts due to the spread of COVID-19.

Estonia Doubles E Residency Fee To Cope With Growing Demand Government Civil Service News

Your nationality residency the tax laws of the country you are in the reason you are receiving international payments and the sum you are receiving can all affect whether or not a money transfer is taxable.

Estonia e residency tax rate. The supplementary tax on individuals is imposed at a progressive tax rate ranging from 015 to 115 and provides for a tax free amount of EUR 250000 of the total value of property rights subject to ENFIA including the value of plots outside urban planning agricultural plots. Citation needed Starting with the Northern Crusades in the Middle Ages Estonia became a battleground. Rate of urbanization.

The Zimbabwean tax system is currently based on source and not on residency. For most business owners the lump sum can reduce the flat tax by 40 or 60 leaving an effective tax. In other words earning profits in itself does not bring income tax liability which arises only when earned profit is.

Moreover the value of property rights on buildings including a potential analogy on the plots on which they are. Theres also a reduced VAT rate of 9. Compared to other Portuguese income tax rates up to 48 this program offers a 20 flat rate on certain Portuguese-source incomes from determined professions and from self-employment Opportunity to have tax residency within the EU in a white-listed country.

Estonia a member of the EU since 2004 and the euro zone since 2011 has a modern market-based economy and one of the higher per capita income levels in Central Europe and the Baltic region but its economy is highly dependent on trade leaving it vulnerable to external shocks. Tax Exemption on almost all foreign sources of income. It has been indicated that Zimbabwe is considering moving to a residence-based system during the current tax reform exercise.

Source is the place where income originates or is earned not the place of payment. Most goods and services are taxed at 20. Legal persons income tax rate is 20 in the year 2015.

Estonias successive governments have pursued a. The value added taxsales tax rate in Estonia is 20. Income derived or deemed to be derived from sources within Zimbabwe is subject to tax.

By the way your tax residency does not change automatically. As a low-tax residency the Czech Republic or Czechia as they prefer is best suited for European Union citizens. VAT is always included within the price so when youre shopping you wont be hit with surprise taxes at checkout.

The history of Estonia forms a part of the history of EuropeHumans settled in the region of Estonia near the end of the last glacial era beginning from around 8500 BCBefore German crusaders invaded in the early 13th century proto-Estonians of ancient Estonia worshipped spirits of nature. Its your responsibility to inform the tax authorities by submitting a. Thats because self-employed Europeans can not only avail themselves of Czechias 15 flat tax rate but may also apply a lump sum tax deduction in lieu of actual expenses.

However the system of corporate earnings taxation currently in force in Estonia is a unique system which shifts the moment of corporate taxation from the moment of earning the profits to the moment of their distribution. Guidance on tax obligations and relief for businesses affected by COVID-19. The best way to ensure youre paying the correct tax and filing the correct payments as exempt from taxation is to seek the help of a professional accountant or tax expert.

PwCs Tax Alerts will ensure you are kept informed of the latest key tax developments and help you respond accordingly. Global Mobility COVID-19 update. -003 annual rate of change.

Blockchain Company In Estonia Blockchain Digital Entrepreneur Estonia

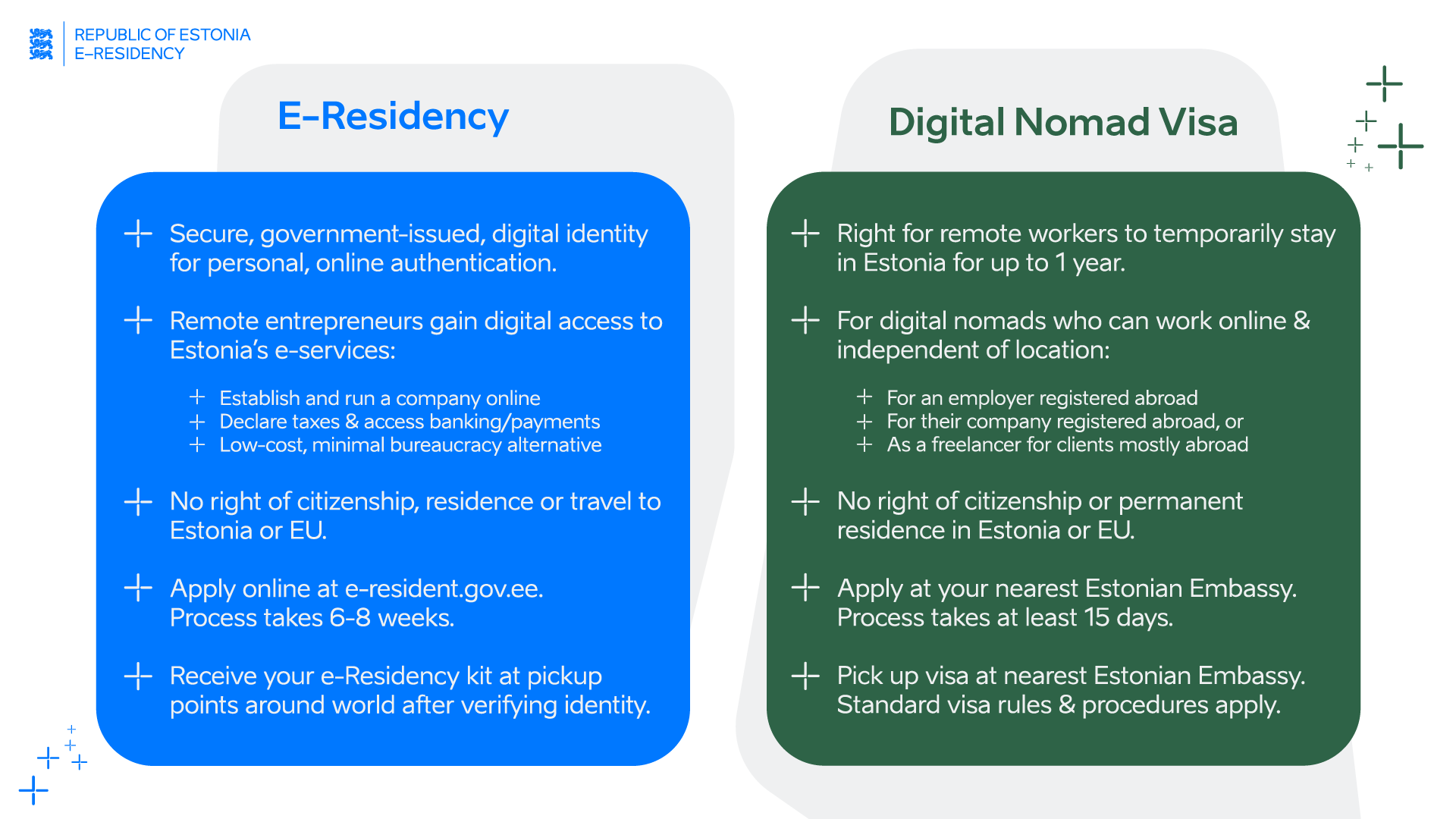

All You Need To Know About Estonia S E Residency Program Sitepoint

How To Work In Partnership With Estonia S E Residency Program By Joel Burke E Residency Blog E Residentsuse Blogi Medium

Estonia S E Residency Program To Expand In 20 More Countries Worldwide Schengenvisainfo Com

How To Get Estonian E Residency The Ultimate Guide Nomad Capitalist

Estonia E Residency Nomads Accounting

What Is Estonia S E Residency And How Can It Help You Kyc Chain

Brexit Business And The E Residency By Comistar Global Comistar Medium

How To Get Estonian E Residency The Ultimate Guide Nomad Capitalist

What Is Estonia E Residency Schengen Visas

Estonian E Residence And Taxation No More Tax

Faqs About Estonia S Digital Nomad Visa Etrade For All

Estonia Launches E Residency Program For Indian Startups Residency Programs Start Up Estonia

How Do E Residents Pay Taxes E Estonia

E Residency Estonia S Government Start Up Emerging Europe

Here S Why Tax Evaders Are Disappointed In Estonian E Residency By Dmitri Jegorov E Residency Blog E Residentsuse Blogi Medium

Estonian E Residency Incorporation Banking Investing Residence Permits Flag Theory